EV talk: why the new Tesla Model S’s road tax would cost RM17k in Malaysia

Elon Musk made headlines again last week when he launched a car with half a steering wheel and enough computing power to run a game that struggled so hard on the PlayStation 4 it had to be pulled off Sony’s online store entirely. It’s a lot of hype for a car that's turning nine years old in 2021. But the Tesla Model S continues to be the benchmark for all things luxuriously electric, which is why people take note whenever something new about it comes along.

Although it was once ‘trialled’ in Malaysia by government agency Greentech, the Tesla Model S was never officially sold here. But the EV landscape has matured, if ever so slightly, since. And the recent buzz surrounding the Porsche Taycan – the Model S’s biggest global threat that made its local debut in 2020 – suggests that the premium market might just be ready for a four-door, all-electric sports saloon.

After all, surely an EV is quieter, cleaner and cheaper to own than a BMW M5 CS or a Mercedes-AMG E63 running on petrol-chugging V8 engines… right?

You’d be ticking most of the right boxes until you reach the tail end of the cost sheet. With fewer oily bits than their combustion counterparts, assuming electric powertrains are easier on the wallet in the long run isn’t exactly a crime. You’d be saving a lot by skipping the pumps too. But the catch is in the road tax, which, as most Malaysians found out with the Taycan, can be pricey for EVs.

The Taycan Turbo S, for instance, will cost owners RM12,094 in annual road tax. That’s nearly double the price of taxing a GT3-spec 4.0-litre engine used in souped-up 911s that are often twice as expensive – a 911 Carrera S’s 3.0-litre engine is even more affordable to tax at RM2,082 a year. So why the huge discrepancy?

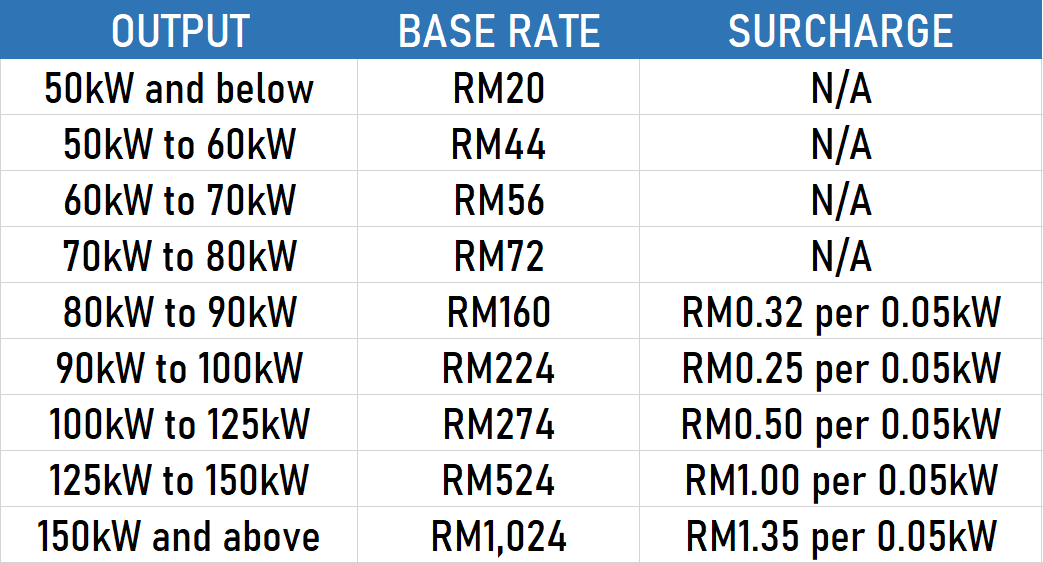

It all boils down to the Road Transport Department’s (JPJ) latest guidelines on the calculation of road tax for EVs based on their electric outputs, which is summarised in the table below. Things are cheap and cheerful right up to the 80kW mark, which is exactly what you’d get from the 1.6-litre engine of a Proton Persona. And it only rises exponentially from there, as is the case with combustion engines (which are measured by their displacements instead) past the 2,000cc mark.

In many ways, taxing cars based on their outputs seems a lot fairer than billing purely on the cubic capacity of their engines. It’s hardly logical to charge an old Toyota Corolla Altis 2.0 the same fee as a RM460k Mercedes-AMG A45 S with 421hp and a substantially higher carbon footprint, but such is the case until JPJ decides to rejig the system. Even that’s a far cry considering the difficulty in accurately ascertaining the outputs of the millions of cars already plying our roads; under-reporting will be a big problem, but that’s a topic for another long debate altogether.

As things stand, there’s a stark contrast between EVs and cars that run on fossil fuel in terms of how their owners are taxed in Malaysia. The priciest bracket in this exponentially-costlier table is for EVs with outputs of 150kW (201hp) or more. And that’s not a difficult figure to breach by modern standards. By the same law, a Mazda CX-5 Turbo would be placed in the same league as the 1,470kW Lotus Evija (which would cost a mind-blowing RM36,664 a year in annual road tax!). The poor SUV would also have its own road tax bumped up from RM868 annually to RM1,564 based on the rates for EVs.

Using this system, the new Tesla Model S Plaid with 760kW would cost you a whopping RM17,494 in road tax annually if it was officially available in Malaysia. That’s RM1,024 for the first 150kW, plus the surcharge for the additional 610kW at the rate of RM1.35 per 0.05kW. The Long Range model with 500kW will be slightly cheaper at RM10,474 a year, but it’s still a precious five-figure sum to part with nonetheless.

That said, you could still rack up a bigger bill than the lightning-quick Tesla with a good-old V12 supercar – ah, the good ol' V12. Ferrari’s 6.5-litre engine powering the 812 Superfast and GTS, for instance, will set owners a mouth-watering sum of RM17,862 a year in road tax. It may seem comparable to the Model S’s figure. But when you factor in the 789hp output of the Ferraris that equates to just 588kW, the 760kW (1,020hp) Tesla – and any other 1,000hp electric supercar for that matter – suddenly seems like better bang for buck.

But the news isn’t all bad for the Prancing Horse, which is now galloping towards an electric future itself. It’s not quite there yet, but the midway point of the journey is where things get interesting. That’s because hybrid and plug-in hybrid vehicles continue to be classified together with other petrol-driven cars in Malaysia as far as their road tax is concerned. What we’re saying is that a 986hp (735kW) SF90 Stradale which costs nearly RM2 million BEFORE duties, options and taxes is assessed like any other sports car with a four-litre mill. This means you’ll only have to fork out RM6,585 to JPJ each year – a very expensive way to trick the system indeed.

At the end of the day, the unique way in which EVs are billed in Malaysia will likely impact the future used market more than the overall industry – one that’s ploughing towards electrification nonetheless – especially in the case of the Taycan (which now starts from just RM585k new) and grey-import Teslas. Because what’s RM10k or RM20k a year to those with seven digits to drop on a brand-new ride?